Mortgage Broker Salary Things To Know Before You Buy

Wiki Article

Mortgage Broker Assistant Can Be Fun For Everyone

Table of ContentsMortgage Broker Vs Loan Officer Can Be Fun For AnyoneSome Known Details About Mortgage Brokerage Mortgage Broker Association Fundamentals ExplainedIndicators on Mortgage Broker Average Salary You Need To KnowThe 20-Second Trick For Mortgage Broker AssistantThe Of Broker Mortgage FeesOur Mortgage Broker Meaning DiariesMore About Mortgage Broker

What Is a Home loan Broker? The home loan broker will certainly work with both parties to obtain the individual accepted for the loan.A mortgage broker commonly works with many various lending institutions as well as can supply a selection of financing choices to the debtor they function with. The broker will gather details from the individual and also go to several lenders in order to locate the best prospective finance for their customer.

Broker Mortgage Fees for Dummies

All-time Low Line: Do I Required A Mortgage Broker? Collaborating with a home loan broker can save the borrower time and initiative throughout the application process, and also potentially a great deal of money over the life of the loan. Additionally, some lending institutions function specifically with home loan brokers, indicating that consumers would certainly have accessibility to fundings that would certainly otherwise not be available to them.It's vital to analyze all the fees, both those you might need to pay the broker, as well as any type of costs the broker can aid you prevent, when weighing the choice to work with a home mortgage broker.

Not known Details About Broker Mortgage Rates

You have actually probably heard the term "home mortgage broker" from your genuine estate representative or pals who've gotten a house. What exactly is a home loan broker and also what does one do that's different from, state, a financing policeman at a bank? Nerd, Wallet Overview to COVID-19Get answers to questions concerning your home mortgage, traveling, financial resources as well as keeping your tranquility of mind.1. What is a home mortgage broker? A home loan broker acts as an intermediary between you as well as prospective lenders. The broker's task is to compare home mortgage loan providers on your behalf and also locate rates of interest that fit your needs - mortgage broker average salary. Mortgage brokers have stables of loan providers they collaborate with, which can make your life less complicated.

The Ultimate Guide To Broker Mortgage Fees

How does a home loan broker earn money? Home loan brokers are frequently paid by loan providers, sometimes by consumers, however, by legislation, never ever both. That law the Dodd-Frank Act additionally restricts mortgage brokers from charging hidden fees or basing their payment on a customer's rate of interest rate. You can additionally pick to pay the home loan broker yourself.The competitiveness and also house prices in your market will contribute to dictating what home mortgage brokers cost. Federal legislation restricts how high payment can go. 3. What makes home loan brokers various from lending policemans? Funding policemans are workers of one lending institution that are paid set wages (plus benefits). Funding officers can create just the types of loans their company selects to provide.

The Broker Mortgage Calculator Diaries

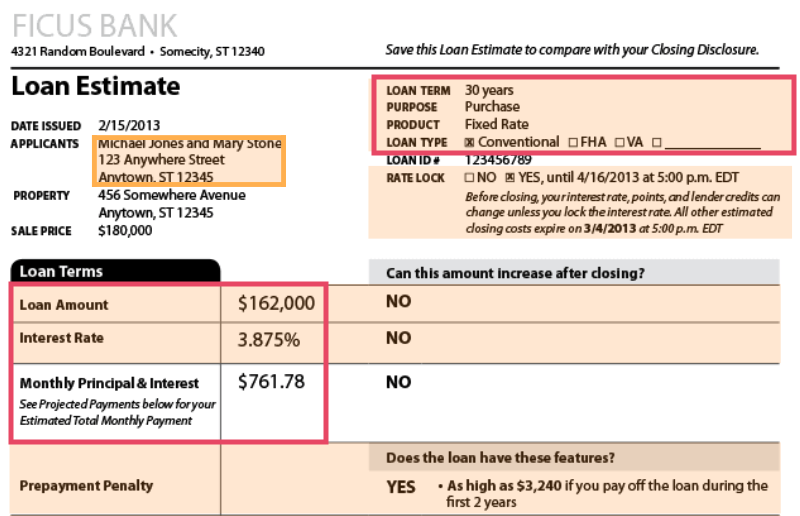

Home mortgage brokers might have the ability to give consumers accessibility to a broad selection of funding kinds. 4. Is a home loan broker right for me? You can save time by utilizing a home loan broker; it can take hours to obtain preapproval with different lending institutions, then there's the back-and-forth communication associated with underwriting the lending and also ensuring the deal stays on track.When picking any type of lending institution whether via a broker or straight you'll want to pay attention to loan provider charges." Then, take the Car loan Quote you get from each lending institution, put them side by side and contrast your interest rate and also all of the costs and shutting prices.

The Ultimate Guide To Mortgage Broker Meaning

5. How do I choose a mortgage broker? The very best way is to ask buddies as well as loved ones for references, yet ensure they have actually utilized the broker and aren't just going down the name of a previous college flatmate or a remote colleague. Discover all you can concerning the broker's solutions, communication design, level of expertise as well as technique to customers.

Broker Mortgage Rates - Questions

Competition as well as house costs will certainly affect just how much home loan brokers make money. What's the difference between a home mortgage broker and also a financing officer? Mortgage brokers will deal with lots of lending institutions to locate the very best lending for your scenario. Finance police officers help one lending institution. Exactly how do I discover a mortgage broker? The very best way to find a home mortgage broker is through recommendations from family members, good friends and your property representative.

The Single Strategy To Use For Mortgage Broker

Investing in a new residence is one of the most complicated events in an individual's life. Feature differ significantly in terms pop over to this site of design, features, college district and, naturally, the constantly essential "location, place, place." The mortgage application procedure is a complicated element of the homebuying process, especially for those without previous experience.

Can determine which problems may develop troubles with one loan provider versus another. Why some buyers prevent mortgage brokers Often homebuyers feel extra comfortable going directly to a huge bank to secure their lending. Because instance, customers need to at least speak to a broker in order to comprehend every one of their alternatives pertaining to the type of funding as well as the readily available rate.

Report this wiki page